At the council meeting on September 17th, with the unanimous approval of council, I happily signed the proclamation declaring in the city of Torrington, constitution week, which ran from September 17 …

This item is available in full to subscribers.

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continue |

At the council meeting on September 17th, with the unanimous approval of council, I happily signed the proclamation declaring in the city of Torrington, constitution week, which ran from September 17 through September 23, 2024. Part of the proclamation was a call to all citizens to study the constitution and reflect on the privilege of being an American with all the rights and responsibilities which that privilege involves. One thing – voting - involves all three…. voting is a right, a responsibility, and a privilege.

If you are eighteen and over you have the right to vote;

If you are blessed to be an American, you have been granted a privilege to be here to exercise that right;

And you have the responsibility to become informed – and then vote intelligently and responsibly regardless of which side of any issue you come down on.

The general election this year is set for Tuesday, November 5, 2024. early voting began on Tuesday, October 8, 2024.

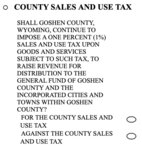

One item on the ballot this year is the option to continue the Goshen County sales and use tax. That ballot measure reads as follows:

I want to give you some data. The City of Torrington uses the optional 1% sales tax mainly on our general fund…for capital improvements, maintenance, internet technology, equipment service, airport, cemetery, fire department, police department, and as match money (skin in the game so to speak) in applications for state and federal grants and private foundation grants. The difference between property tax and sales tax is that sales tax is charged on goods and services purchased in Goshen County by residents and visitors and non-residents.

This is not an additional tax. We are just asking to continue the 5th Penny. The tax rate will stay the same. (5.25%)

Food purchases are tax exempt.

A good portion of Agriculture related purchases are tax exempt as well.

This is not a permanent tax. It is renewed every 4 years.

This tax is also paid by non-residents and visitors on purchases in Goshen County.

This optional sales tax has been in effect for 20 years. it was first passed by the Goshen County electorate on November 2, 2004. it was last voted on in the general election in 2020. it passed, 72% for and 28% against.

This optional tax benefits greatly the City of Torrington, the County of Goshen, Fort Laramie, LaGrange, Lingle, and Yoder.

The amount received for fiscal year 2024 is as follows:

General Purpose Optional Tax Revenue (Wyoming Department of Revenue)

FY24 FY23 FY22 FY21

Goshen County

1,111,994 1072,708 953,474 868,949

Fort Laramie

43,492 41,955 40,245 36,678

Lagrange

78,538 75,764 78,392 71,443

Lingle

85,083 82,078 81,892 74,632

Torrington

1,291,872 1,246,231 1,137,556 1,036,711

Yoder

27,657 26,681 26,422 24,080

Total

2,638,637 2,545,417 2,317,981 2,112,493

This can be confusing, but I hope to clarify this:

This 1% sales tax on the election ballot this year has nothing to do with Go Goshen or economic development’s ¼% sales tax that was on the general election ballot in November of ’22.

Those are separate and not at all related with each other.

The 1% sales tax renewal is only payable to Goshen County, City of Torrington, Towns of Fort Laramie, LaGrange, Lingle, and Yoder.

PLEASE BECOME INFORMED

PLEASE EXERCISE YOUR RIGHT TO VOTE

Special thanks to Clerk/Treasurer Lynette Strecker

for compiling and organizing this data and information.